Contract of guarantee (126)

Contract of guarantee: A contract of guarantee is a contract to perform the promise made or discharge the liability, of a third person in case of his default.

Surety - A person who gives the guarantee,

Principal debtor - Person in respect of whose default the guarantee is given,

Creditor- Person to whom the guarantee is given

Example 1 : When A requests B to lend `10,000 to C and guarantees that C will repay the amount within the agreed time and that on C falling to do so, he will himself pay to B, there is a contract of guarantee.

Here, B is the creditor, C the principal debtor, and A the surety.

Example 2 : Where ‘A’ obtains housing loan from LIC Housing and if ‘B’ promises to pay LIC Housing in the event of ‘A’ failing to repay, it is a contract of guarantee.

Example 3 : X and Y go into a car showroom where X says to the dealer to supply the latest model of Wagon R to Y. In the case of Y’s failure to pay, X will be paying for it. This is a contract of guarantee because X promises to discharge the liability of Y in case of his defaults.

So we can say,

Guarantee is a promise to pay a debt owed by a third person in case the latter does not pay.

Any guarantee given may be oral or written.

From the above definition, it is clear that in a contract of guarantee there are, in effect three contracts

(i) A principal contract between the principal debtor and the creditor

(ii) A secondary contract between the creditor and the surety.

(iii) An implied contract between the surety and the principal debtor whereby the principal debtor is under an obligation to indemnify the surety; if the surety is made to pay or perform.

The right of surety is not affected by the fact that the creditor has refused to sue the principal the debtor or that he has not demanded the sum due from him.

Essentials of a Contract of Guarantee

1. Three Contract

2. Liability

3. Essentials of a Valid Contract

4. Writing is not necessary

Three Contracts

•

(i) A principal contract between the

principal debtor and the creditor

•

(ii) A secondary contract between the

creditor and the surety.

• iii) An implied contract between the

surety and the principal debtor whereby principal debtor is under an obligation

to indemnify the surety; if the surety is made to pay or perform

2. Liability

•

Under

such contract the primary liability is of the principal debtor and

•

only

secondary liability is of the surety.

•

As

a conditional contract, the liability of the surety arises only when the principal

debtor (primarily liable) defaults.

It

is also as same as another general contract in respect of essentials. All the

requirements for a valid contract, i.e. free consent, consideration, lawful

object, competency of the parties etc. are necessary to form this kind of

contract.

But,

in respect of consideration, no direct consideration in the contract between

the surety and creditor. Consideration of principal debtor is considered to be

adequate for the surety.

4. Mode of Creation:

The Indian legal framework does not compel to form

such contract in written form. Both written and oral is valid in India.

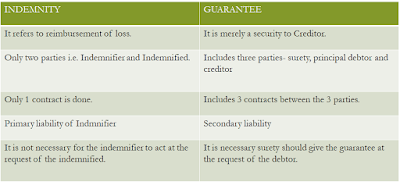

Distinction between a

Contract of Indemnity and a Contract of Guarantee

Nature and Extent of Surety's Liability

The liability of the surety is co-extensive with that of the principal debtor unless it is otherwise provided by the contract.

Explanation :

(i) The term

“co-extensive with that of principal debtor” means that the surety is liable for

what the principal debtor is liable.

(ii) The liability of a

surety arises only on default by the principal debtor. But as soon as the

principal debtor defaults, the liability of the surety begins and runs

co-extensive with the liability of the principal debtor, in the sense that the

surety will be liable for all those sums for which the principal debtor is

liable.

(iii) Where a debtor

cannot be held liable on account of any defect in the document, the liability

of the surety also ceases.

(iv) Surety’s liability

continues even if the principal debtor has not been sued or is omitted from

being sued. In other words, a creditor may choose to proceed against a surety

first, unless there is an agreement to the contrary.

Example: A guarantees to

B the payment of a bill of exchange by C, the acceptor. The bill is dishonoured

by C. A is liable not only for the amount of the bill but also for any interest

and charges which may have become due on it.

Nature of Surety’s

liability can be summed up as

(a) Liability of surety

is of secondary nature as he is liable only on default of principal debtor.

(b) his liability arises

immediately on the default by the principal debtor

(c) The Creditor has a right to sue the surety directly without first proceeding against principal debtor.

Rights of a Surety

Rights of surety maybe

classified as under :

(a) Rights against the

creditor,

(b) Rights against the

principal debtor,

(c) Rights against

co-sureties

Right against the

Creditor

Surety’s right to benefit

of creditor’s securities [Section 141] : A surety is entitled to the benefit of

every security which the creditor has against the principal debtor at the time

when the contract of suretyship is entered into, whether the surety knows of

the existence of such security or not; and, if the creditor loses, or, without

the consent of the surety, parts with such security, the surety is discharged

to the extent of the value of the security.

Example 1 :

C advances to B, his tenant, 2,00,000 rupees on the guarantee of A. C has also

a further security for the 2,00,000 rupees by a mortgage of B’s furniture. C

cancels the mortgage. B becomes insolvent, and C sues A on his guarantee. A is

discharged from liability to the amount of the value of the furniture.

Right against the

principal debtor

(a) Rights of subrogation

[Section 140] :

Right of subrogation means that on payment of the guaranteed debt, or performance of the guaranteed duty, the surety steps into the shoes of the creditor.

(b) Implied promise to

indemnify surety [Section 145] :

In every contract of

guarantee there is an implied promise by the principal debtor to indemnify the

surety. The surety is entitled to recover from the principal debtor whatever

sum he has rightfully paid under the guarantee, but no sums which he has paid

wrongfully.

Rights against

co-sureties

(a) Co-sureties liable to

contribute equally (Section 146) :

Equality of burden is the

basis of Co-suretyship. This is contained in section 146 which states that

“when two or more persons are co-sureties for the same debt, or duty, either

jointly, or severally and whether under the same or different contracts and

whether with or without the knowledge of each other, the co-sureties in the

absence of any contract to the contrary, are liable, as between themselves, to

pay each an equal share of the whole debt, or of that part of it which remains

unpaid by the principal debtor”.

Example 1: A, B and C are sureties to D for the sum of 3,00,000 rupees lent to E. E makes default in payment. A, B and C are liable, as between themselves, to pay 1,00,000 rupees each

(b) Liability of

co-sureties bound in different sums (Section 147) : The principal of equal tcontribution is, however, subject to the maximum limit fixed by a surety to his

liability. Co-sureties who are bound in different sums are liable to pay

equally as far as the limits of their respective obligations permit.

Example 1 :

A, B and C, as sureties for D, enter into three several bonds, each in a

different penalty, namely,

A in the penalty of

1,00,000 rupees, B in that of 2,00,000 rupees, C in that of 4,00,000 rupees,

conditioned for D’s duly accounting to E. D makes default to the extent of

3,00,000 rupees. A, B and C are each liable to pay 1,00,000 rupees.

Example 2 :

A, B and C, as sureties for D, enter into three several bonds, each in a

different penalty, namely, A in the penalty of 1,00,000 rupees, B in that of

2,00,000 rupees, C in that of 4,00,000 rupees, conditioned for D’s duly

accounting to E. D makes default to the extent of 4,00,000 rupees; A is liable

to pay 1,00,000 rupees, and B and C 1,50,000 rupees each.

Comments

Post a Comment